In the world of finance particularly in Nigeria, there are few opportunities as lucrative as becoming an Opay aggregator or agent. These positions offer the chance to tap into a vast and growing market, while also providing valuable services to your community. In this article, I will show you the practical steps on how to become an Opay aggregator or Agent

But what exactly is an Opay aggregator or agent? And how can you become one?

In a nutshell, an Opay aggregator is a middleman between Opay and its agents. They’re responsible for onboarding new agents, providing them with the necessary equipment and training, and managing their day-to-day operations.

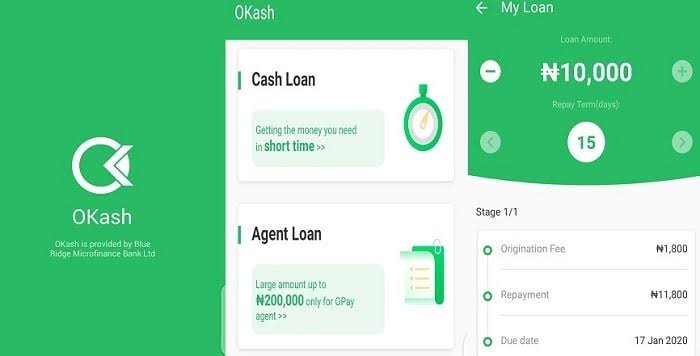

As an agent, you’ll be responsible for providing Opay services to your customers. This includes things like selling airtime, making bill payments, and transferring money.

Why should you become an Opay aggregator or agent?

There are a few reasons. First, the market for Opay services is huge. In Nigeria alone, there are over 200 million people who use mobile money. And that number is only going to grow in the years to come.

Second, the margins on Opay services are very good. As an aggregator, you can expect to earn a commission of around 5% on every transaction. And as an agent, you can earn even more.

To become an Opay aggregator and agent, you need to understand the services offered by Opay, which include:

Mobile Money Services

Opay’s mobile money services enable users to perform various financial transactions, such as sending and receiving money, paying bills, and purchasing airtime. As an agent, you will play a crucial role in ensuring these services are accessible to customers in your area.

POS Services

Opay provides Point-of-Sale (POS) services to businesses, allowing them to accept digital payments securely. By becoming an Opay aggregator, you can offer this service to merchants, contributing to the growth of cashless transactions in your community.

The Main Benefits of Becoming an Opay Aggregator and Agent

Before going into the steps to become an Opay aggregator and agent, let’s explore the benefits of embarking on this venture, they include;

-

Lucrative Commission Structure

Opay offers an attractive commission structure for its agents, providing a rewarding income stream for your efforts.

-

Wide Range of Services

As an Opay aggregator, you will have access to a diverse range of financial and non-financial services, expanding your business opportunities.

-

Cutting-Edge Technology

Opay utilizes cutting-edge technology to ensure seamless and secure transactions, enhancing the overall customer experience.

-

Flexibility and Independence

Becoming an Opay agent grants you the flexibility to set your working hours and operate as an independent entrepreneur.

Requirements to Become an Opay Aggregator and Agent

To become an Opay aggregator and agent, certain prerequisites must be met. Here are the key requirements:

Business Registration

Ensure that your business is officially registered with the appropriate authorities such as CAC as Opay prefers to work with legitimate entities.

Physical Location

You will need a physical location for your business, which could be a shop or kiosk, from where you will offer Opay’s services.

Capital

The minimum capital requirement for Opay aggregators is NGN50,000.

Mobile Phone and Internet Connectivity

As a digital platform, Opay relies on mobile phones and the internet to conduct transactions. Ensure you have a reliable smartphone and internet connectivity.

Step-by-Step Guide to Becoming an Opay Aggregator and Agent

Now that you understand the fundamentals let’s dive into the step-by-step process of becoming an Opay aggregator and agent:

Step 1: Research and Understanding

Begin by conducting thorough research about Opay, its services, commission structure, and terms of partnership. Understanding the company’s vision and values will help align your business strategy accordingly.

Step 2: Meet the Requirements

Review the prerequisites mentioned earlier and ensure that your business meets all the necessary criteria. Register your business if required and secure a suitable physical location for your operations.

Step 3: Contact Opay

Reach out to Opay through their official website to express your interest in becoming an aggregator and agent. They will guide you on the next steps and provide you with necessary documentation.

Step 4: Complete the Application

Opay will provide you with an application form, which you need to fill out accurately. Attach any required documents and submit the application to Opay for review.

Step 5: Training and Onboarding

Upon approval of your application, Opay will provide training and onboarding sessions to familiarize you with their platform, services, and best practices.

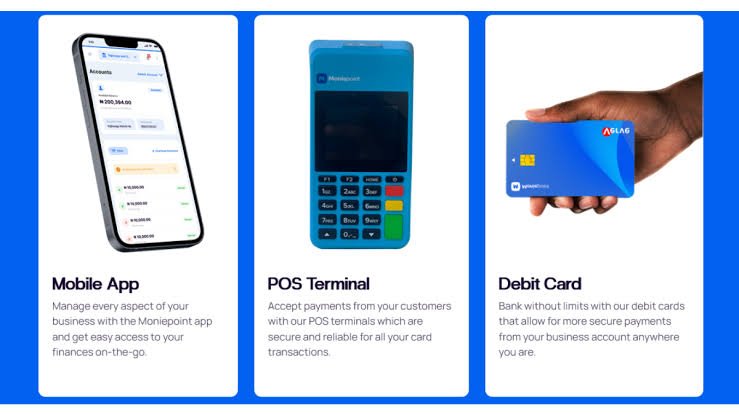

Step 6: Obtain Necessary Equipment

Procure the required equipment, including a smartphone, POS machine (if applicable), and any other tools necessary for delivering Opay services.

Step 7: Launch and Promotion

With everything in place, launch your Opay aggregator and agent business. Implement marketing strategies to create awareness about your services within your community. And start earning massively

Conclusion

That’s all about how to become an Opay Aggregator and Agent. Thanks for reading to this end.

FAQS

What is an OPay aggregator?

An OPay aggregator is a person or business that partners with OPay to distribute and manage OPay POS devices to other agents. Aggregators are responsible for training and onboarding new agents, as well as providing them with support and technical assistance. As I have mentioned earlier, they also earn a commission on every transaction that their agents process.

How do I become an OPay agent online?

To become an Opay Agent online, kindly follow this steps I went through when I got mine.

1 Download the OPay app.

- You can download the OPay app from the Google Play Store or Apple App Store.

- Once you have downloaded the app, open it and create an account.

- To create an account, you will need to provide your phone number and a password.

- You will also need to verify your phone number by entering a code that will be sent to you.

2 Upgrade your KYC level to 3.

- To upgrade your KYC level to 3, you will need to provide OPay with your BVN, a recent utility bill, and a valid ID card.

- You can do this by going to the “Me” tab in the OPay app and clicking on “Upgrade to Level 3.”

- Once you have submitted your documents, OPay will review them and approve your request within 24 hours.

3 Apply for a merchant POS terminal.

Once your KYC level has been upgraded to 3, you can apply for a merchant POS terminal. To do this, go to the “Merchant” tab in the OPay app and click on “Apply Merchant.”

You will need to provide some information about your business, such as your name, address, and business type. You will also need to upload a copy of your business registration certificate.

Once you have submitted your application, OPay will review it and approve it within 24 hours.

If your application is approved, you will receive your POS machine within 72 hours.